Welcome to another year of our property reports. As always, our goal is to keep people in the area updated on what is happening. Without the spin, bravado or embellishment.

We are a tiny bit pleased to report that so far, it's been a busier than expected start to the year. There have been more buyers around and more people making offers. We aren't calling it a recovery just yet, but the energy has certainly changed in our world over the first few weeks of 2023. A lack of properties on the market has mainly driven this.

First home buyer choice

Over the last couple of months, we have been letting you know about the NSW government's First Home Buyer Choice. This new scheme allows some buyers to forgo the huge burden of up-front stamp duty by replacing it with an annual tax. This came into effect with pretty limited fanfare earlier this year.

This may, however, be a very short-lived program. If Labor wins the upcoming March state election, they have vowed to scrap this policy altogether. Instead, they plan to increase the existing threshold where stamp duty kicks in for first-time home buyers. Currently, this is pegged at $650,000, which they propose to increase to $800,000. Purchases up to $1,000,000 will see a concessional rate applied. As always, there are a handful of conditions and exclusions. Typically, these sorts of changes drive behaviour which could positively impact prices, so we will be watching this closely.

Regional areas

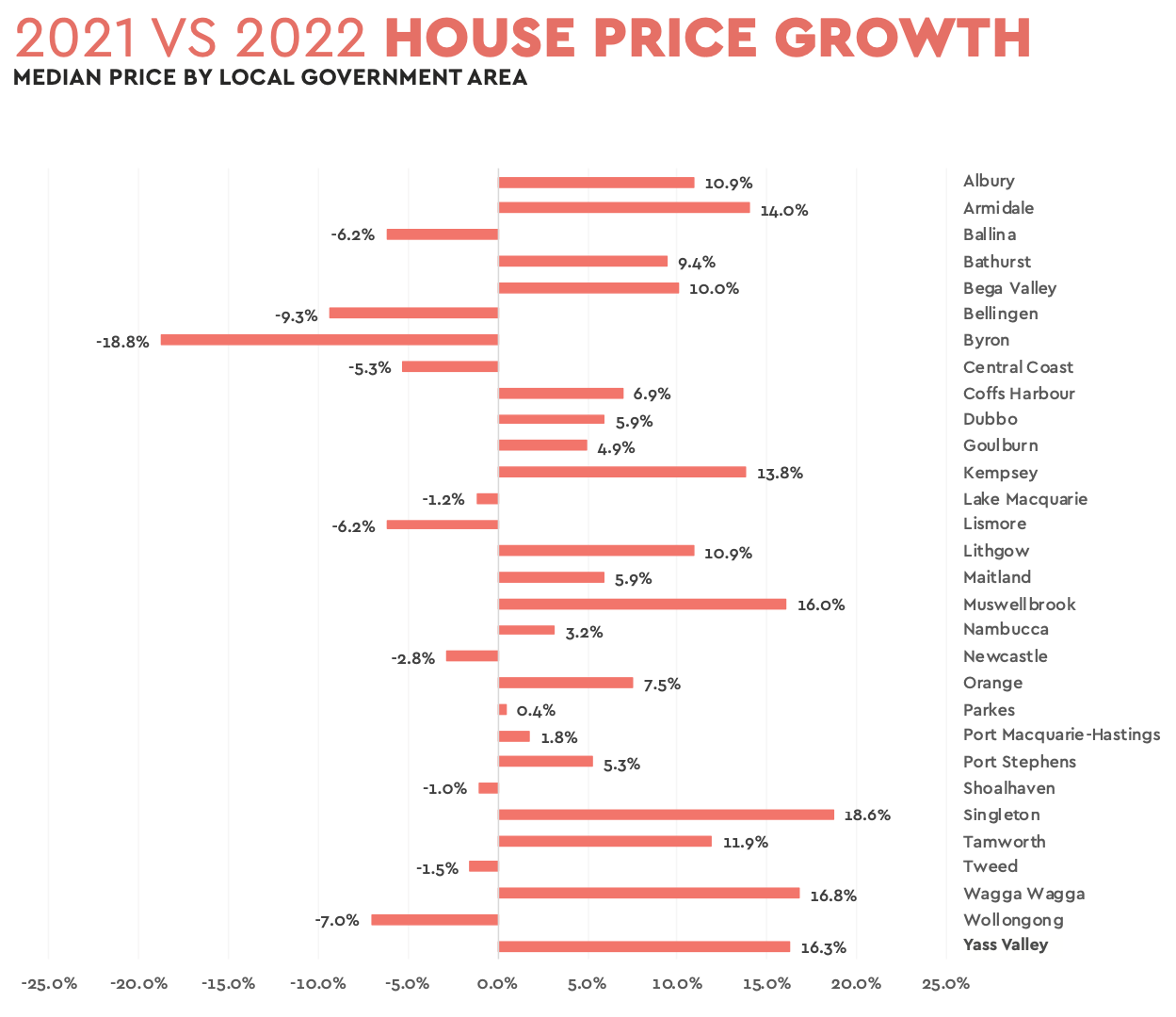

Below, we have highlighted what is happening with prices across various locations in NSW. Every area did very well during the pandemic, though prices have stabilised since.

The biggest loser this year has been the Byron Shire, where the median house price has dropped $345,000 over the past 12 months. With a median house price of $1,495,000, this beautiful pocket of our state is considered the top end of the market.

It should be noted though, that Byron Shire was the biggest winner for the previous two years where prices almost doubled during the pandemic. Even with the recent drop, prices are still up 49% since December 2019.

The graph indicates to us that prices have gone backwards in the largest metropolitan areas, including here in Newcastle as well as Lake Macquarie and Wollongong. It is not surprising that the biggest population centres would lead the change in the market. Nor the decline in prices in top-priced areas as these were the ones to inflate quickest during the boom.

Some of the smaller LGAs reported have far fewer sales and are statistically less reliable.

Suburb records

We have also included all the record sales prices by suburb for the last 12 months. This is hardly a scientific way of measuring market performance. For example, one area could see its median house price halve and, at the same time, have one single outstanding result. But they are a good reference point.

Given all the negativity in the media about falling home values, you would think there were fewer record sales in 2022 than in 2021. But that is not the case. Of the 87 suburbs listed, 64 reported record sales. Just 23 suburbs had a higher priced sale in 2021 versus 2022.

You also wouldn't be crazy to assume that most of these records would have occurred in the first half of the year before the interest rate hikes took the wind out of the market. But again, that would not be the case! Forty were record prices from July onwards.

Yes, people were still paying suburb record prices right up until the festive season with 20 Beluga Drive, Cameron Park, seeing a record $1,900,000 price tag the week before Christmas.

It is hard not to notice the Merewether sale. This is the highest priced home we can find in Newcastle. Ever.

In the year ahead, all eyes will be on the RBA and the direction of interest rates. Many economists believe we are near the peak, and a period of stabilisation will follow. Our feeling is that the pace of price declines has softened, and the statistics back that up. At some point, prices will rebound. When that happens is really anyone's guess.