For most of this year, the good folk of Newcastle have been reluctant to sell their homes and move. Many were nervous about media reporting or interest rates. Many just thought it wasn’t the right time (as frustrating as that was for us agents and many buyers still in the market).

But that dam wall has now burst. September was our busiest month for new listings ever. And I am sure we weren’t alone. In the suburbs where we work, we have seen a significant uptick in new stock hitting the market.

This supply/demand imbalance experienced for most of the year meant that prices failed to fall despite rising interest rates. This has defied the expectations of many economists around the country. It seems the simple logic of rising rates leads to falling prices didn’t compute this time around. And it certainly has been a long time since we have seen sustained interest rate increases – over ten years.

Increased listings have provided buyers more choices, reducing the urgency to purchase and allowing for greater negotiation with sellers. We are still meeting plenty of buyers. No one wanted to commit a year ago as they thought prices would drop further. Nowadays, they will take their time as the lure of another new listing keeps people's emotions in check.

Our experience on the ground is that sales results are patchy. One week we are having plenty of buyers and amazing prices. The next, we might need to be having price adjustment conversations with our owners. One thing that is clear is that whatever homeowner we speak to, they believe prices are going through the roof. We aren’t sure if this is buoyed on by desperate agents with no listings or the media reporting national results rather than local ones. In any case, sellers still need to be cautious and avoid being over-confident and under prepared for the reality of the market forces at play.

In terms of the numbers, data provider CoreLogic is reporting a 0.8% increase in Australian dwelling prices in September, marking the eighth consecutive month of growth. This rise comes on the back of a 0.7% uptick in August, resulting in a quarterly growth rate of 2.2% for the September quarter. However, it's worth noting that this quarterly growth has decelerated from the 3.0% gain observed in the June quarter. This slight slowdown can largely be attributed to the above-mentioned increase in advertised housing stock levels, consistent not just here in Newcastle but across the country.

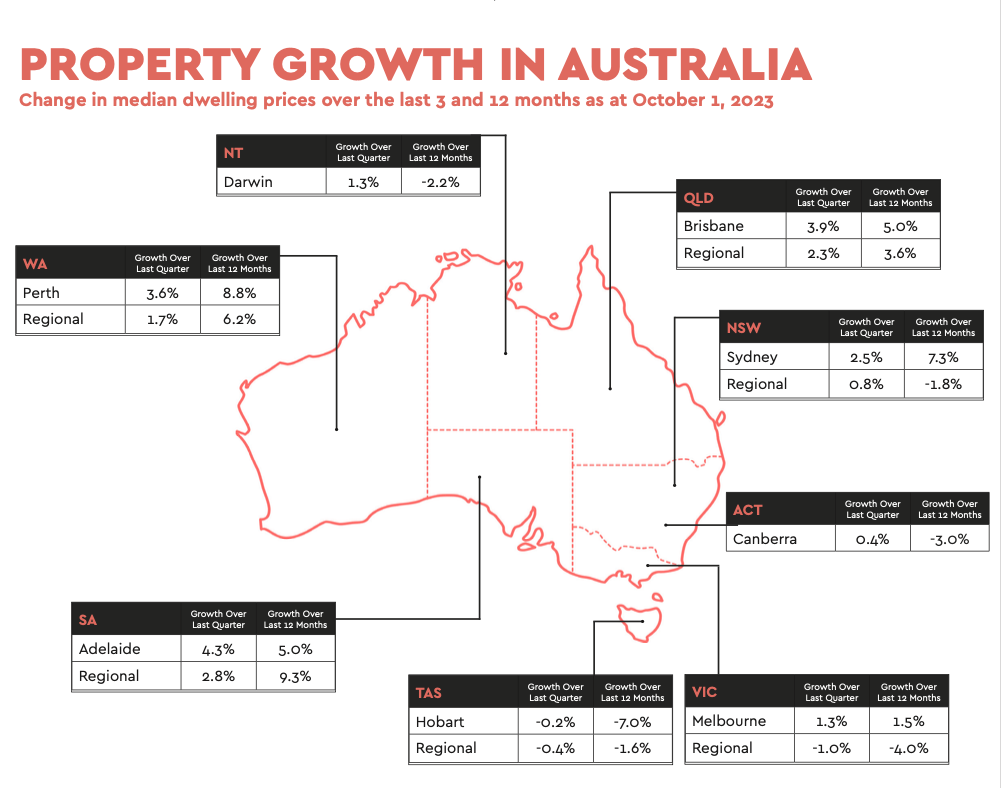

In the September quarter, Adelaide took the lead in terms of capital gain, with an impressive 4.3% increase, followed closely by Brisbane at 3.9% and Perth at 3.6%. On the opposite end of the spectrum, Hobart saw a slight decline of -0.2% in property values during the quarter, bringing the southern capital to a new cyclical low. Interestingly, the three cities experiencing the most significant capital gains have advertised supply levels approximately 40% below their previous five-year averages. As a rough comparison here in Newcastle, our supply levels appear about 20% lower than average, but that is changing quickly.

Since hitting a low point in January, national prices have rebounded by 6.6%. However, after falling in the back half of 2022, home values remain 1.3% below the record highs recorded in April of that year. At the current growth rate, the prices are expected to reach a new nominal high by the end of November.

In contrast to the capital cities, regional markets (like ours) are experiencing weaker growth conditions, with each "rest of state" region reporting less growth than their capital city counterparts in the September quarter. Combined regional markets saw a 1.1% increase in dwelling values during that period, less than half of the 2.5% gain observed in combined capital city markets.

The softer housing conditions in regional Australia appear to be demand-driven, with the estimated number of home sales down by 6.5% compared to the previous year and 9.2% lower than the last five-year average. To us, this simply means that people were pouring out of capital cities during the pandemic. But now, that flood has turned into a trickle. Sure, we see Sydney relocators every weekend, but nowhere near the level we saw two years ago. It wouldn’t surprise us if the regional tourist hotspots of places like Byron Bay were the worst performers this year.

How long this ‘rebound’ lasts is anyone’s guess. The housing sector is still facing challenges, including high interest rates, which make it difficult to qualify for credit, rising living costs and a three-percentage point serviceability buffer. The cost of living crisis and persistent low consumer sentiment also play a part.

Housing affordability is well and truly back in the national conversation. The ratio of dwelling values to household income (7.4) and the time required to save for a deposit (9.9 years) are rising as housing values outpace wage growth again. The portion of household income dedicated to servicing a new mortgage is approaching record highs at 45.5%, as is the percentage allocated to rent on a new lease (31.4%).

It appears that a housing undersupply may worsen before showing signs of improvement. Annual dwelling approvals have not been this low since 2013 (excluding the mid-2020 dip caused by the onset of COVID). Despite a forecast of record population growth in the coming five years, we are still not building enough homes across the country.

Our preference would be for slow and steady growth over the next couple of years. The boom/bust gyrations over much of the past decade make life tricky for many, including us. But what we want and what we get are two very different things. Bring on 2024!