Given all the hype, you’d think the market has never been hotter than it is today. But the data points to something a little different. Over the last 25 years, there have been a few periods of significant growth. And a few periods of falls. But now is one of the times where prices are neither rising at meteoric rates, nor falling into a chasm.

For now, anyway.

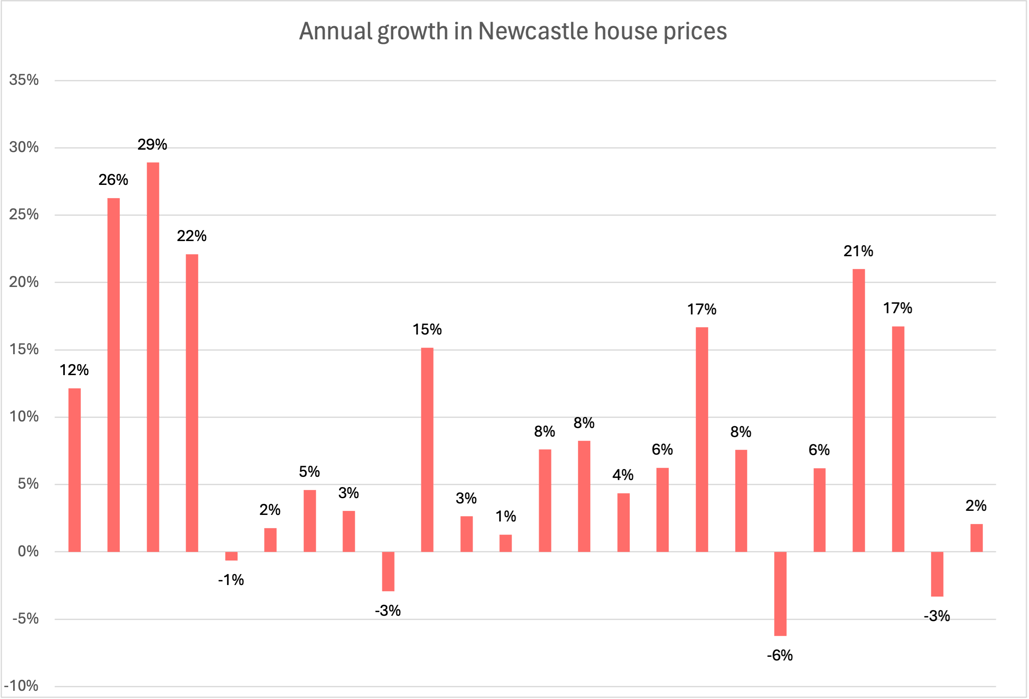

To get a glimpse into the future, we thought it would be interesting to look back at what has happened over the last 25 years. The graph opposite shows the year-on-year change in house prices in the Newcastle LGA, recorded in June, compared to the same figures a year earlier.

There are some clues as to what drives the market.

In the final decade of the 1900’s, Australia endured the ‘recession we had to have’. Due to excessive growth in the late 1980s, interest rates peaked at around 18%. Within a year, unemployment climbed above 10%, and as a result, there were eight straight months of economic decline. It was a devastating time for many. Over time, interest rates fell, and things recovered.

When the Howard government took the keys to The Lodge in 1996, it halved the tax on capital gains on investment properties (provided it was held for at least one year), which was an incentive for investors to buy.

Back in 2000, the median house price in Newcastle was $140,000. So, when the government started providing first-home buyers with a $7000 grant to buy a home, it was enough for a 5% deposit. Given that banks were prepared to lend 100% of a property's value (often on interest-only loans), it was no wonder first homebuyers decided en masse that there was never a better time to buy.

This lit the spark for what was to become one of the biggest booms in property prices in Australian history. Money was cheap, and buyers were motivated. And not unsurprisingly, things exploded. Between 2000 and 2003, Australian home prices increased a massive 65%, with even higher growth here in Newcastle. That $140,000 median house price in June 2000 shot up over 80% to $255,000 within three years. This was a period when BHP shut down, and many naysayers thought it was the end of Newcastle.

But like all good things, booms must come to an end. The government can’t afford to have assets inflating too quickly as that will lead to inflation (and as we all know from the last year or two, that ain’t great). To cool the market, the RBA increased the cost of borrowing. The cash rate moved from 3.5% up to a peak of 7.25% in September 2008, taking the heat completely out of the market.

Then the GCF hit, and the financial world started melting down. Shortly after (in 2009), Australian home prices dropped a sharp 8%. Here in Newcastle, our drop was lower, at 3%.

In response, the Rudd government stimulated the market by doubling the first home buyers grant to $14,000. Money was pouring into the economy with school halls, pink batts, and plenty of other worthy projects. Interest rates dropped 4.25% within a year, and suddenly, money was cheap. And people were happy to borrow (again).

We were largely insulated from the global meltdown. Most people just got on with life, and more than a few were happy to take advantage of the cheaper cost of finance. In response to the worldwide downturn, China stimulated its economy, and our resources sector boomed. It was around this time that we started in real estate. And it felt like every buyer was a cashed-up miner, ready to spend.

As the market rose in 2010, the RBA increased rates, with the cash rate going up 1.75%, again cooling the market.

The next spark came from Sydney. For most of the 2010s, Sydney prices climbed slowly and steadily. The cumulative effect was that prices rose 72% in five years, and those with houses suddenly had plenty of equity. The lure of tapping into that equity to purchase an investment property was too strong for many. And where better to buy than in Newcastle?

The 17% price jump here in 2017 was heavily driven by Sydneysiders, often pushing locals aside. Another contributing factor was the State Government’s decision to scrap stamp duty for first-home buyers up to a $650,000 purchase price—another government incentive.

2019 was a dark year for agents around the country. Interestingly, it was not the RBA that slowed the housing market. This time around, it was the Australian Prudential Regulatory Authority. APRA keeps tight control over banks around the country, and it used its influence to slow the amount of money that could be loaned.

Banks were forced to restrict the number of investors they were lending to. In response to the Royal Commission into poor lending practices, APRA required borrowers to be able to service much larger loans to qualify for a mortgage. Rather than making loans more expensive, the net effect was that the buyer pool got smaller as many dropped out of the market, unable to get a loan. Unsurprisingly, the market slowed.

And then came COVID. Again, at a time when it seemed the world was coming to an end, money poured into the economy from government stimulus, and once again, a fuse was lit. The RBA cash rate dropped to just 0.1%, the lowest in Australian history.

It is often said that the market is moving forward because more people are coming into the country than we are building homes for. And there is a lot of truth in that. But that is a little too simplistic.

As you see by this turbulent period, there are many global factors out of our control. And how the government of the day responds makes a substantial impact. Interest rates and the availability of money are a huge lever. Booms don’t last forever, and periods of minimal growth often lead to substantial gains.

So, when someone asks us at an appraisal whether to sell now or in a year, it is not an easy question to answer. The market is a living-breathing thing with its own reality that often acts unpredictably. However, keeping an eye on key economic data and government decisions is probably the best indicator of what the future holds. That’s why we have been discussing interest rates a lot lately.